What to do if IRS is pending my Cash App tax refund?

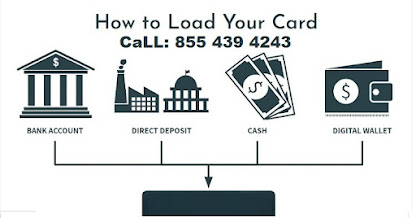

The first step is to create an account with Cash App. Once you have an account, log in to your account and enter your routing and account numbers. You'll receive your refund via direct deposit within two business days. You can spend the funds until they're in your Cash App balance. You must be an American citizen and have a valid routing number to set up direct deposit.

Your refund should arrive in less than a week if you file on time. You can also file for an extension. The IRS will delay your refund for up to six months, so the longer you wait, the longer you have to wait. You can try to contact the IRS, but they're not likely to be helpful. The IRS will help you with any issues related to your application.

If your cash app tax refund is pending, you can buy U.S. Series I savings bonds. In this case, your refund will be higher because you've bought a bond, not the original amount. The additional refund will be sent to your routing and account number. If you didn't provide a routing and account number, you could send the check to the address on the form.

Cash App Transfer Failed | Activate cash app card | Cash App Refund | Cash app Login Issue | Cash App Direct Deposit | How to Unlock cash app | Cash App account Closed | Check Cash App Balance | Cash App Declined by Bank | Cash App Cash out Failed | Cash App add cash Failed | Where can i load my cash app card | How to reset cash app pin | Cash App Limit | Cancel Cash App Payment | Cash App not working | cash app Down | Where Can I load my cash app card

Comments

Post a Comment